The Buzz on Insurance In Toccoa Ga

Wiki Article

The Definitive Guide to Health Insurance In Toccoa Ga

Table of ContentsMedicare Medicaid In Toccoa Ga Things To Know Before You BuyMore About Annuities In Toccoa GaLittle Known Facts About Commercial Insurance In Toccoa Ga.Not known Details About Health Insurance In Toccoa Ga

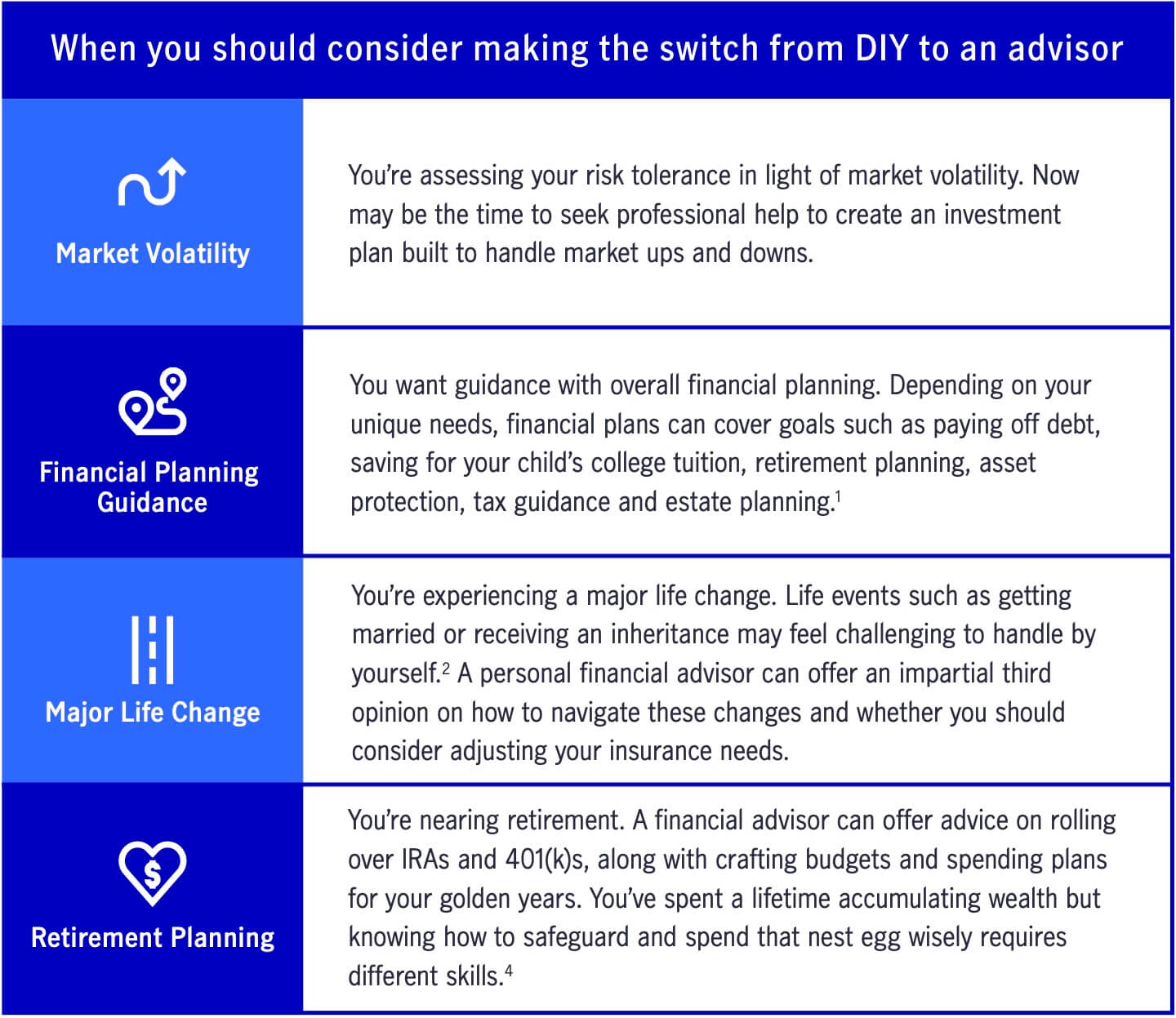

A financial expert can additionally help you choose just how ideal to attain goals like saving for your child's college education or settling your financial obligation. Monetary consultants are not as well-versed in tax obligation regulation as an accounting professional may be, they can offer some assistance in the tax planning process.Some financial experts provide estate preparation services to their customers. It's crucial for financial advisors to stay up to date with the market, financial conditions and advising best practices.

To market investment products, advisors must pass the pertinent Financial Sector Regulatory Authority-administered exams such as the SIE or Series 6 exams to acquire their certification. Advisors who wish to market annuities or other insurance policy items must have a state insurance permit in the state in which they plan to offer them.

The Definitive Guide to Annuities In Toccoa Ga

You hire an expert that charges you 0. Due to the fact that of the common cost structure, many experts will not work with customers who have under $1 million in possessions to be handled.Financiers with smaller portfolios might choose a financial consultant that bills a per hour cost rather of a portion of AUM. Hourly fees for experts typically run between $200 and $400 an hour. The even more facility your monetary circumstance is, the even more time your expert will certainly need to devote to managing your assets, making it more costly.

Advisors are skilled professionals who can help you develop a plan for monetary success and execute it. You may also consider connecting to an advisor if your personal financial circumstances have actually lately come to be a lot more difficult. This can suggest acquiring a residence, marrying, having youngsters or obtaining a large inheritance.

The 30-Second Trick For Final Expense In Toccoa Ga

Before you fulfill with the consultant for a preliminary assessment, consider what services are crucial to you. Older grownups may require assist with retired life preparation, while younger adults (Automobile Insurance in Toccoa, GA) may be looking for the best way to invest go now an inheritance or beginning an organization. You'll intend to look for an advisor who has experience with the solutions you want.What business were you in prior to you got right into monetary advising? Will I be functioning with you directly or with an associate consultant? You might likewise want to look at some sample monetary plans from the expert.

If all the samples you're supplied are the exact same or similar, it may be an indication that this consultant does not properly tailor their advice for every client. There are three main sorts of economic suggesting specialists: Licensed Economic Planner experts, Chartered Financial Experts and Personal Financial Specialists - https://www.webtoolhub.com/profile.aspx?user=42362864. The Certified Financial Planner professional (CFP expert) certification suggests that a consultant has fulfilled a specialist and ethical requirement set by the CFP Board

Some Known Incorrect Statements About Medicare Medicaid In Toccoa Ga

When choosing a monetary expert, take into consideration somebody with a specialist credential like a CFP or CFA - http://www.place123.net/place/thomas-insurance-advisors-toccoa-united-states. You may additionally take into consideration an expert who has experience in the solutions that are crucial to youThese advisors are usually riddled with conflicts of passion they're extra salesmen than advisors. That's why it's critical that you have an advisor that works just in your benefit. If you're looking for an expert who can truly provide genuine value to you, it is necessary to look into a number of possible choices, not simply select the given name that promotes to you.

Currently, numerous consultants have to act in your "benefit," but what that involves can be practically void, except in one of the most outright situations. You'll need to locate an actual fiduciary. "The initial test for a good financial expert is if they are functioning for you, as your advocate," states Ed Slott, certified public accountant and founder of "That's what a fiduciary is, yet everyone claims that, so you'll need various other signs than the consultant's say-so and even their credentials." Slott suggests that customers seek to see whether consultants spend in their ongoing education around tax obligation planning for retirement cost savings such as 401(k) and IRA accounts.

0, which was passed at the end of 2022. "They must confirm it to you by revealing they have taken severe recurring training in retired life tax and estate planning," he states. "In my over 40 years of method, I have seen costly irreparable tax obligation errors since of lack of knowledge of the tax guidelines, and it is however still a big problem." "You need to not attach any advisor who doesn't purchase their education and learning.

Report this wiki page